According to the latest Smithers market report, “The Future of Flexographic Printing Markets to 2029”, the global flexo printing market, valued at $230.5 billion (£177.6 billion) in 2024, is on track to grow at a steady compound annual growth rate (CAGR) of 3.0%, with projections indicating a market value of $267.2 billion (£205.9 billion) by 2029.

The report revealed that flexo output is growing across most applications – notably packaging. Growth in this segment is forecast to continue, driven by economic demand, particularly from e-commerce and consumer-facing boxes.

Flexible packaging, labels, and folding cartons will also see growth, according to the report. Changes in print buying will make digital more competitive with flexo on shorter runs. The widespread adoption and strong ongoing sales of hybrid presses mean that flexo volumes are holding up and will continue to grow, the report stated. In contrast, flexo printing of newspapers, bags and sacks, and envelopes will decline as demand in these end-uses falls.

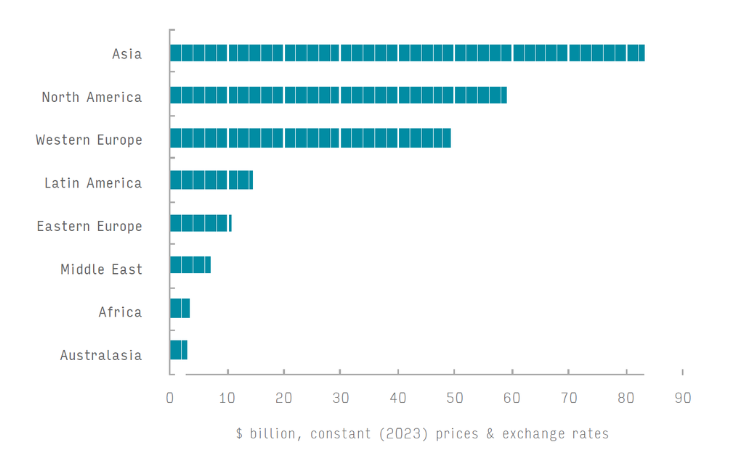

In 2024, flexographic presses globally printed 8.6 trillion A4 sheets, with this number expected to grow to 10 trillion sheets by 2029. The three largest markets for flexo printing – Asia, North America, and Western Europe – account for over 80% of global volume and value. Asia is set to experience the strongest growth, with a 5.8% CAGR forecast through 2029, particularly in India. Meanwhile, North America and Western Europe are expected to see slower growth rates at 2.3% and 1.7% CAGR, respectively.

Another Smithers report, “The Future of Retail-Ready Packaging to 2029”, forecasts that the demand for corrugated and plastic shelf/retail-ready packaging will reach 42.7 million tonnes in 2029, with value rising to $69.2 billion (£53.4 billion) at constant 2023 prices.